Don't be an idiot when Buying a Car.

A car is often the second most expensive thing people buy after a house. If you don't buy smartly it can be at a huge detriment to your ability to not only build wealth but not be straddled with either debt if you have chosen to buy a car with finance or the exodus of nearly all your savings after buying a car outright.

The average UK salary in 2021 was £31,285 per statista. After taxes this would have been £24,706 based off of the 21/22 tax rules. According to YouGov the average Briton plans to spend around £10,000 as can be seen from the graph below. This is almost half of the average workers wages after tax which if you haven't deduced already is nuts considering the amount of other expenses we have in our lives.

Now unless you have an outrageous passion for cars, you need to remember that a car is simply a tool. It is nothing more than a tool and it does not reflect anything about you as a person depending on what car you drive. Unfortunately far too many people buy cars that are not suitable for their financial situation either out of insecurity or outright stupidity. I want to highlight some key things that you should take into consideration when buying a car.

Never Buy a Brand New Car

Unless you are a millionaire, you need to steer well clear of buying brand new cars. The reason for this is that in the first year of a cars life it will experience the greatest amount of depreciation. Depreciation is used to measure how much of an assets value has been lost over a specified time period.

Imagine you buy a brand new car for £20,000 and after a year it is worth £15,000. This means the car has depreciated in value by £5,000 (25%), because now the car has a value of £15,000 which is what it could be sold for on the second hand car market.

You might be thinking, that the low maintenance costs in a cars first year of ownership will be so low that this will offset the high level of depreciation. It is correct the maintenance costs will be extremely low in a cars first year of life unless it has a freak accident. However, the depreciation is so high in that first year it will always be the most expensive year of ownership.

On average cars will depreciate by 15-25% in their first year. Luxury cars will experience higher rates of depreciation compared to your more basic cars. The graph below shows how depreciation differs between a BMW 7 series (luxury car) and a Honda Civic (economical car). The BMW experienced 27% of depreciation in its first year which means it has decreased in value by $28,206 ($104,465 x 27%).

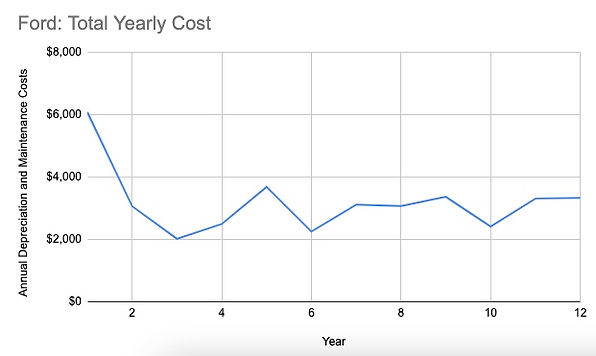

The question you need to be asking yourself is what is the cheapest year of a cars life to buy in at. The graph below shows the average yearly depreciation and maintenance costs for the average Ford over 12 years. The car initially costs $30,000. As you would expect depreciation is at its highest in its first year and begins to tail off. In addition, the maintenance costs creeps up each as more work on the car is required.

Source: Car Edge

When looking at the combined average annual depreciation and maintenance costs for a Ford, you can see that from the 2nd year onwards the annual cost of owning the car remains fairly consistent. The average combined cost in year 2 is $3,063, which differs only slightly to year 12 at a cost of $3,328. The cheapest year of ownership is the 3rd year at a mere $2,020.

At what point in a cars life would I recommend you buy in at?

The combined annual depreciation and maintenance costs for the majority of cars is pretty consistent to the graph above, unless you are buying luxury cars where the depreciation is likely to be quite steep for the first 2 to 3 years of a cars life.

Therefore, if you are buying a basic car, as long as you are not buying brand new car then it doesn't make a huge difference as to what year you buy in at. Some people say that the best time is between years 2 and 4 of a cars life. However, I would very much say it depends on your financial situation, because for the majority of people cannot afford to buy a car outright that is only a few years old. In addition, the combined annual cost of owning basic cars is fairly consistent after the first year, so if you bought a car that was 6, 7 or 8 years old, it won't make a whole lot of difference to the average annual costs.

You might think that financing a car would make sense, but I would try to steer if you can. Reason being, you are then paying a further additional cost of the interest on the monthly payments. There are certainly times when financing a car makes sense, but for the majority of people it doesn't, especially when the car is worth at least half of your annual salary. Remember if a car is worth half of your annual salary that means 6 months of your wages will be required to pay it off in full over the course of the financing agreement.

In summary, don't buy a brand new car unless you would happily welcome some disgustingly high levels of depreciation in a cars first year. Instead think of getting at least a car that is already at least a year old and think of the additional holiday you would be able to go on with the money saved.

It goes without saying to do your due diligence when buying a second hand car. There are unfortunately some people out there who will try to rip you off. If you can, it is worth getting a mechanic to have a look at the car you are thinking of purchasing to flag any potential issues which you may be unaware of. For example, you can book someone from the AA to carry out a basic vehicle inspection for £142 or a comprehensive inspection for £192. Or if the car comes from a garage with warranty then you will be able to sleep a little easier if any problems do arise.

Fix up, buy smart.